How Hard Money Atlanta can Save You Time, Stress, and Money.

Wiki Article

Hard Money Atlanta Can Be Fun For Anyone

Table of ContentsSome Known Details About Hard Money Atlanta Unknown Facts About Hard Money AtlantaThe Only Guide to Hard Money AtlantaThe Hard Money Atlanta Diaries

:max_bytes(150000):strip_icc()/GettyImages-1137516784-604537c07dad40eea021db81f5527ecf.jpg)

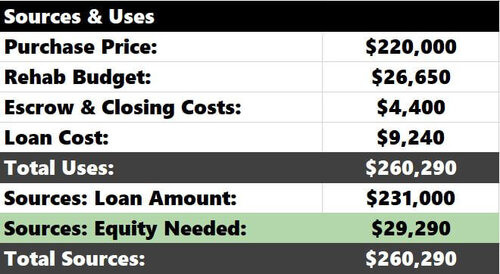

By comparison, rates of interest on tough cash loans begin at 6. 25% however can go much higher based on your place and the home's LTV. There are other expenses to bear in mind, as well. Tough money lenders commonly bill factors on your car loan, often referred to as source costs. The factors cover the administrative prices of the lending.

Points are usually 2% to 3% of the funding amount. 3 factors on a $200,000 lending would certainly be 3%, or $6,000.

What Does Hard Money Atlanta Mean?

You can anticipate to pay anywhere from $500 to $2,500 in underwriting costs. Some hard cash lending institutions additionally charge prepayment fines, as they make their money off the interest fees you pay them. That indicates if you pay off the financing early, you might need to pay an additional cost, contributing to the car loan's price.This implies you're more probable to be offered funding than if you got a conventional home loan with a suspicious or thin credit rating background. hard money atlanta. If you require cash promptly for remodellings to turn a house for revenue, a difficult cash funding can provide you the cash you require without the problem and documents of a typical mortgage.

It's a strategy investors utilize to acquire financial investments such as rental properties without using a great deal of their own possessions, as well as difficult cash can be valuable in these situations. Although tough cash lendings can be helpful for genuine estate investors, they need to be utilized with caution especially if you're a newbie to property investing.

If you skip on your car loan payments with a difficult cash lender, the consequences can be serious. Some lendings are personally ensured so it can damage your credit scores.

Hard Money Atlanta Things To Know Before You Buy

To discover a credible loan provider, talk with relied on property agents or home mortgage brokers. They might be able to refer you to loan providers they have actually collaborated with in the past. Tough money loan providers likewise often attend investor meetings to ensure that can be a great area to attach with lending institutions near you. hard money atlanta.Equity is the value of the property minus what you still owe on the home mortgage. The underwriting for house equity finances likewise takes your credit scores history as well as earnings right into account so they often tend to have lower interest prices and longer repayment durations.

When it concerns moneying their next bargain, genuine estate capitalists and also business owners are privy to several offering options practically created real estate. Each includes particular requirements to gain access to, as well as if used effectively, can be of significant benefit to capitalists. One of these loaning types is difficult check my blog cash financing. hard money atlanta.

It can also be called an asset-based financing or a STABBL car loan (temporary asset-backed bridge financing) or a bridge lending. These are obtained from look at these guys its particular temporary nature and also the demand for tangible, physical collateral, normally in the type of actual estate property.

The Definitive Guide for Hard Money Atlanta

They are considered short-term swing loan as well as the major use case for hard cash fundings remains in property transactions. They are thought about a "tough" cash lending since of the physical possession the real estate home called for to protect the loan. In click for more case a debtor defaults on the loan, the lender reserves the right to assume ownership of the property in order to recoup the funding sum.In the very same capillary, the non-conforming nature affords the lending institutions a possibility to choose their very own specific needs. Because of this, needs may differ considerably from lending institution to loan provider. If you are looking for a finance for the very first time, the authorization procedure might be reasonably strict and also you may be needed to give extra details.

This is why they are generally accessed by property entrepreneurs that would normally require rapid financing in order to not lose out on warm opportunities. On top of that, the lending institution mainly thinks about the worth of the property or residential property to be acquired instead than the borrower's personal finance history such as credit rating or revenue.

A conventional or bank car loan might use up to 45 days to shut while a difficult money loan can be shut in 7 to 10 days, in some cases quicker. The benefit as well as speed that hard money lendings supply stay a major driving force for why real estate investors choose to use them.

Report this wiki page